Uploaded Doordash and Frubhub Came With It

Yous've been a Doordash delivery driver for a bit, you've received your directly deposits upwards until now. Just where are the Doordash pay stubs? How do you get your paystubs for employment verification with Doordash?

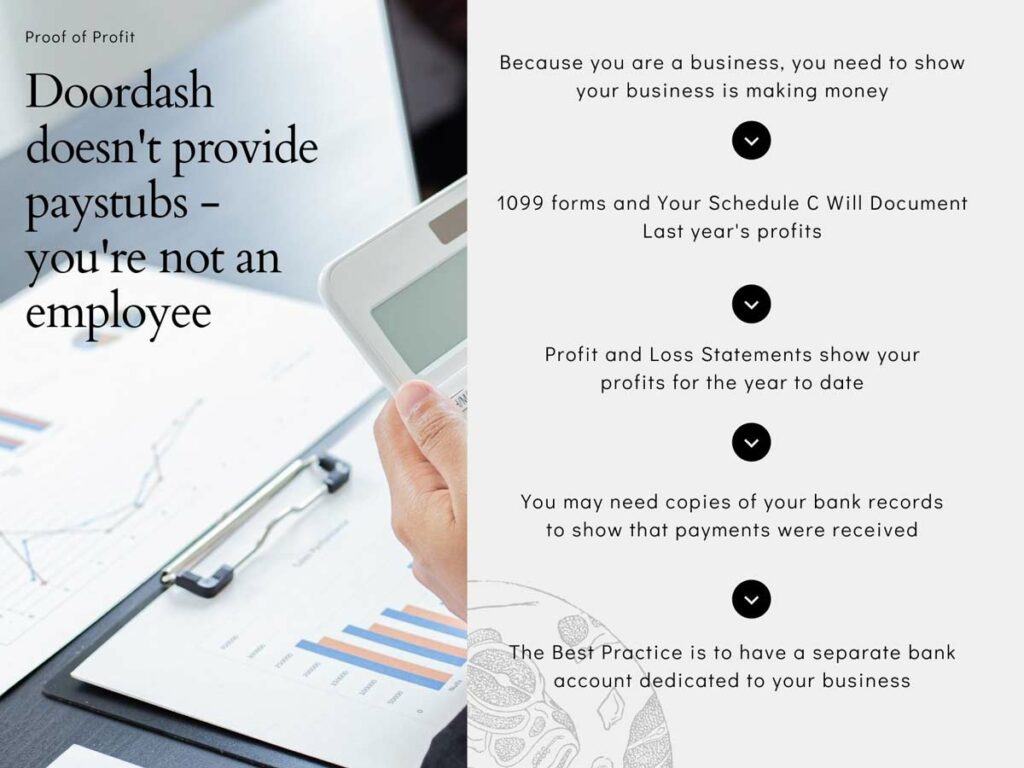

I have some bad news for you lot. You lot can't. Doordash doesn't provide any of that considering ultimately, Doordash drivers are not Doordash employees.

Now what?

This doesn't mean you're out of luck. You lot don't necessarily demand paystubs or employment verification. Yous just need to understand what yous do need as an contained contractor, and as a business possessor. It might take a little bit of a mindset shift. We'll talk about all that, including:

- How business records replace paystubs, Doordash earnings statements and employee income verifications

- Five steps to create your own income and self employment verification

- Frequently asked questions nigh Doordash pay stubs and earnings statements.

How business records supplant paystubs, Doordash earnings statements, and employee verification.

Technically, as an independent contractor, yous're a business possessor. That's truthful of all Doordash delivery partners in the U.s.a.. You lot have to wait at your income verification (and simply plain income as a whole) differently.

This means Doordash is neither your employer or your boss. They're actually your customer. You lot are a small business concern operator, taking out delivery orders for Doordash equally a business, and non as an employee.

For that reason, y'all will never get employment verification from Doordash Inc. or any other food delivery app. There are no payment stubs or W4's or annihilation of that nature.

This is going to crave a mindset change.

It means you'll have to start thinking like a business possessor.

Whether you lot feel like a business possessor is irrelevant. An independent contractor for Door dash or any other gig economic system delivery apps is technically a business owner. Your independent contractor agreement says you are, as does the IRS.

Hither's what this means: You exercise not tell whoever needs documentation (whether a bank, mortgage lender, holding manager, prospective employer, whoever) that you are a Doordash employee. Afterward all, y'all aren't.

Telling them you're an employee creates an expectation for employment verification, paystubs, all of that from Doordash. At present you've created a situation where you can't give them what they're request for. Because in the end, you're not an employee.

What you have to do is tell them you're self-employed. Explain that yous are in business organization for yourself.

That doesn't mean they don't want verification. In fact they probably will want more. However, if y'all know what to provide, y'all're in a good position to do that.

Y'all have to create your own documentation with business records.

Since y'all're self-employed, it'southward all upward to you.

Thus, you need to be prepared to provide the business organization records they need.

It might hateful that some folks won't work with y'all. In my opinion, yous probably dodged a bullet. This is an age where more than and more are cocky-employed, either through the gig economy or other entrepreneurial or freelance opportunities. If the people requiring verification aren't with the times you may exist meliorate off not working with them.

Yous no longer have a paycheck. At present you take profit. You no longer take an employer. At present you have customers.

When you competently arroyo your fiscal situations equally a business owner, with a business mindset, and providing actual business records, you'll exist able to provide the data they need.

Your business records, especially your profit and loss statement, allow yous to create your own Pay stub and income verification from your Doordash app (and possibly other third party delivery app) deliveries.

Vii steps to create your ain income and self employment verification

Share this Image On Your Site

Click on the text box below to copy the lawmaking. Please include attribution to EntreCourier.comHither's the thing. If you lot get in with the idea that y'all're sort of employed merely not employed, and then don't have whatsoever good records, you're shooting yourself in the human foot. Shoving your earnings folio off your Dasher app in their face is not going to satisfy them.

Let'south be real: approaching any of this as a concern owner puts yous at a disadvantage. Most folks that want your pay stubs or earnings statements expect to see that you're actually making coin. Many businesses are NOT making money.

The truth is, most folks trust a paystub more than they trust someone'southward business organisation. If yous want to use your business organization income the best manner to approach it is to come at this professionally and with good information. Here are some things that I would tell you lot.

You'll find a summary of the steps for creating your own business records in the menu beneath. Then you tin can scroll down for more particular.

Tools

- A business organization mindset

- A banking company account for your business income and expenses

- An easy to utilize volume keeping plan

Instructions

- Start thinking like a business organization owner. Sympathize here that you are not an employee but you are operating a business concern. Doordash is no longer your employer but your customer. The money y'all go from Doordash is not your income, information technology'southward your business organization's income. Start thinking in terms of profit and loss and start treating your business concern like a concern.

- Open a depository financial institution account for your commitment business concern. If y'all're going to tell a lender, property director or prospective employer that you're running a business concern, they want to see that yous're treating information technology like a business. Have your Doordasy earnings direct deposited into your business bank account, pay expenses out of that account, and requite yourself a paycheck out of what'due south left over.

- Get a accounting program. Find an easy to use program that volition rails all of your income and expenses. Find something that will let you run business reports.

- Go along your business organization records up to date. When you receive money for your commitment work, record that income in your bookkeeping software. When y'all have expenses, tape those besides. Recording it as it happens is a lot easier than waiting til the stop of the year and trying to effigy information technology out.

- Starting time tracking your actual car expenses as well as your miles. We all know that you need to track your miles. Yet, when you're presenting business reports information technology'due south important to exist able to show your actual expenses (and thus your actual profits) as well.

- Run your business reports. Call up, when you're presenting information to lenders or property managers, they want to know what you really made. If you tell them that you are cocky employed, you're running a business concern, AND yous take a profit and loss study that is up to date. that's going to go a long way towards satisfying their requirements.

- Keep documents backing up your business organisation income. Anyone can brand up numbers on a plan like Hurdlr. Yous still need to show folks that the numbers y'all are showing them are based on reality. Bank records from your business bank account showing deposits, tax forms and 1099's from previous years are all things that will show that your income was real.

Notes

None of these are a guarantee. There are ii big route blocks you may face.

one. Some folks aren't very flexible. They desire the easy that comes with paystubs. They don't want to do the work of looking through business organisation records. Yous're better off without them.

2. You may not qualify. You could observe out your actual income wasn't what you thought information technology was, because you were thinking of money in, rather than profit. Sometimes that's a wake up telephone call that you lot either need to step upwardly your game or motility on to something else.

one. Think similar a business owner

The beginning pace is to quit looking at your directly deposits from Doordash or anyone else as a paycheck. The best affair y'all tin can exercise is first thinking of it as your BUSINESS'southward income, not yours.

Understand that income for your business organization is the profit, not the money coming in. Your real income as a business organisation possessor is the money that is left over afterwards expenses.

If all you walk in with is a list of the deposits y'all received from Doordash, you lot probably aren't going to get whatever information technology is you want. That'southward because the people you're dealing with understand that businesses have expenses. Oft a LOT of them. Coin in isn't enough.

From at present on, you need to be thinking like a business owner. Y'all're not seeing the delivery fees and the customer tip amount from Doordash orders equally your income. Instead, it's what's left over after expenses that's your income. When you do that, you also begin thinking about how to keep those expenses downwardly.

2. Open a bank business relationship for your delivery business

Okay, and so you walk in and tell people yous're self-employed. Yous say y'all don't have a Paystub, you're not a Doordash employee, merely y'all're running a business and you have income from that business.

They're impressed. Until you provide your documentation. Your depository financial institution records for your business are all mixed in with your personal bank records.

It'southward not a good look.

If you want them to have you seriously as a business possessor, yous need to treat this like a business organization. One of the best practices for that (if non THE best) is to accept a bank account for your business concern.

Become your directly eolith from Doordash (and any others) sent to your business organisation account. Pay your business expenses from that account. Do Not use the business relationship for personal expenses. Keep personal and business organisation separate. This besides ways doing abroad with fast pay. The idea here is to not treat your business income every bit spendable coin until you've taken intendance of the business organisation side of things.

Giving yourself a paycheck from your business bank account.

These things are not necessary for income verification purposes. However, they are things that can go a long way to ane) expanding your business mindset, and 2) helping others take yous seriously as a business organization.

This is what I do with my coin and expenses for my delivery business:

- All of my earnings from my Doordash account, Grubhub, Uber Eats and some of the smaller apps are deposited into my business organisation account.

- Each week, I figure out how much to save for taxes, and movement that money into a tax savings account.

- I created a second savings account for paid time off. I calculate a pct of my profits and prepare that bated, so that if I want to have a long time off, I tin still pay myself for how much fourth dimension I want off from my PTO account.

- At that place's ane more savings business relationship: for business expenses. Every week I put xxx cents for every mile I drove into that business relationship. When I buy gas or get auto maintenance, I pay for it out of that account.

- Later on taking coin out for taxes, paid time off, and expenses, I practice an ACH transfer of the rest over to my personal checking business relationship. That'due south when I'm giving myself a paycheck.

How do you lot find a practiced banking company account for your delivery business organization?

At that place are a lot of options available.

My credit marriage allowed me to create a 2d checking account and let me create multiple savings accounts, or buckets. That worked very well for me until I concluded up creating an EIN for my business.

If you prefer local cyberbanking, you tin can telephone call effectually and find out if any will give you a complimentary business account. Become something with debit carte access that doesn't hit you with minimum residue fees or annihilation like that.

Personally, I somewhen started an business relationship with Novo. Novo is a fintech company, powered by its cyberbanking sponsor Middlesex Federal Savings, F. A. , more like an online banking concern than your typical brick and mortar financial institution. I similar them because they have no fees, no minimums, they're easy to utilize, and they let me create multiple reserves. There I can keep my paid time off, tax and expense accounts and very hands motion them back and along.

You can use my referral link to start an business relationship. Full disclosure: I may receive referral fees. That said, there are a lot of options out there for business banks. The principal thing is, become an account where you can continue your concern and personal spending separate.

3. Get a practiced bookkeeping plan

You don't need something complicated. But you should have some form of bookkeeping for your business. There are some great low cost or even costless options available.

Here's what I would tell y'all to expect for:

- Find something easy to apply.

- Get something you can access from your phone or your computer.

- A program with GPS tracking is preferable – which allows you to incorporate your mileage expenses into reports.

- Find something that will create business reports for you. In detail, something that can let y'all create a profit and loss written report.

Personally, I found Hurdlr to be the best option. It's easy to use, it'south flexible, and it lets me track things that some apps like Stride won't let you track. The free version is the all-time free tracker on the market in my opinion. The subscription version has some automation features that make it quite powerful.

Hither are some articles and reviews on some accounting apps that are out there:

- My review of Hurdlr

- A comparison of several mileage and expense tracking apps

- A review of GoDaddy Accounting

- A review of Quickbooks Cocky Employed

4. Keep your records upwardly to date

Now that you take something to record your expenses, start recording.

Every time you get paid, put an entry into your program. With every expense, tape it.

Here'due south where information technology'due south a big deal to have a banking concern account just for your business. If all of your business concern transactions are through your business account, this makes things sooooooooooo much easier. Some programs like the Hurdlr subscription version will automatically link to your bank, and all you have to practise is tell the program what your expenses were for.

Y'all would be surprised how valuable it tin can be to have up to date business records. Hither are some different means those records tin bail you out:

- Every year, at least one food delivery service like Doordash, Grubhub, Instacart and others spiral up the 1099'south. They get them wrong or don't even ship i out. If you accept good records, yous can just pull up your program, run a study, and you lot know what you made.

- With the latest rounds of the PPP and the EIDL, at that place were some income requirements based on eight-week periods or quarterly income. If you already had your income and expenses entered into your accounting plan, you lot could pull those reports easily.

But the chief matter here, for the point of this article, is that actually doing bookkeeping is one of the best ways to be taken seriously if your business income is needed for some form of verification.

If you want to learn more than about bookkeeping for your delivery business organization, you tin can read about vii rules for easier bookkeeping for your Doordash business.

five. Start tracking all your car expenses

Anybody tells you to track your miles. You should.

But don't only track miles. Proceed track of your actual expenses as well. No, you cannot claim them on top of your miles. That'south not the reason.

The reality for those of us who drive a lot for our business concern is that we really accept two profits. There'southward the taxable profit and the existent globe profit. Near of the states are paying well less than the IRS allowed 56¢ per mile (2021) to use our cars. Challenge the boosted mileage amount is neat for taxes, just smaller profits aren't and then nifty when trying to utilize business records as a replacement for a Doordash paystub or income verification.

Only hither'south the affair. If you're trying to authorize for something based on your income from your business concern, you're going to be taken more seriously when you actually understand both your real-world profit and your taxable profit.

This is why I stress getting a accounting program that will allow you practise that. Some programs similar Stride Taxation don't let you track that because they presume you'll just merits miles.

The affair is, if your taxable income is low because of the mileage allowance, when y'all can say this is what it Really cost to apply your car, you have a ameliorate chance of overcoming those concerns.

6. Run your business reports

By and large the report is a profit and loss statement.

The profit and loss statement tells whoever's evaluating information technology how much income you had coming in. It likewise breaks down the kind of expenses you had. In the end, information technology volition tell you lot your profit (if yous fabricated more than than your expenses) or your loss (if your expenses were greater than your total earnings).

That printed out P&Fifty is ultimately your Doordash pay stub. This is the thing that lets them what you actually made.

If you've filed taxes in the by for your self-employment income, that Profit and Loss might sound familiar. Schedule C is called Profit and Loss from Business. Nosotros think of information technology as taxation deductions but they're really business expenses. Schedule C is actually your tax version of a W2 for a given calendar yr, in that it provides the ane number that says how much you lot earned, and that number is added to your other taxable income for income taxation purposes.

7. Proceed documents of your business organization income.

When you walk in and say I made this much money and hand over your Profit and Loss statement, that'south probably not quite enough to satisfy them. Anyone can download Hurdlr and brand up some numbers.

Now you lot accept to back it upward.

How do yous do that?

Doordash is pretty useless for these purposes. In fact you meet a bit of their true colors.

In their Dasher back up in that location's a section where they tell y'all to open up a case and request documentation. It leaves the impression they'll do something for yous.

Don't count on it.

I've tried information technology out. I know several others. We go along getting the same reply: Y'all can go your earnings history from the earnings tab in your app.

There are some issues with that. There's no option to impress that out. Bigger than that, earnings records in the app simply go dorsum a few months.

And as I mentioned earlier, you tin can't exactly shove your Dasher app in the face of the loan officer or manager and say hither y'all go!

Information technology's really too bad Door dash is equally bad as they are. Grubhub sends an electronic mail with every transaction. Uber Eats lets you log in and download a detailed payment history.

And Doordash lets you accept a screen shot of a few months worth of income.

And then how practise you lot certificate what you earned.

Banking company records and tax records.

For last yr and before, you tin use your 1099 forms. It's also a good practice to accept a copy of your Schedule C and tax forms. All of that establishes that you lot really were in business.

And then there's the bank statements. This is another reason to go a split banking company account. If you walk in with pages of personal expenses mixed in with your business expenses, there'south a higher risk they won't take yous seriously every bit a business concern possessor. If they take to wade through all of that, there'due south a good take chances they'll be showing you the door.

And practise yous really want to show off all your personal expenditures to them?

Printing out your business account bank records gives proof of the payments yous received, peculiarly in the current year. It also isn't cluttered up by non-business items.

Frequently asked questions well-nigh Doordash pay stubs and earnings statements.

That's it in a nutshell. That'due south how you come up with your Doordash Pay Stubs: you lot do it yourself. Do information technology in the grade of business records.

Some of these questions beneath may have been answered in whole or in part. Forgive me if I echo myself on any of that, simply I wanted to respond them here in case you lot happened to just skip down to these questions.

Tin I get a paystub from Doordash?

No. Y'all are not an employee, so there is no paystub. In fact Doordash doesn't provide whatsoever form of printable earnings record. The Doordash back up center lets yous asking an earnings history. Nevertheless, Doordash customer support typically comes back and says you lot can just get it off the earnings tab in your Doordash commuter app.

Will I get a W2 from Doordash?

No. A Doordash W2 is only for Doordash employees. Dashers are independent contractors. Y'all would instead receive a 1099-NEC at the end of the year if your earnings were more than $600.

How do I get Doordash employment verification?

You can't. There is no proof of employment because you are not an employee. You contract with Doordash as a business concern. With that in mind, you would need to instead provide proof of business income.

Is a separate bank account required for my Doordash business?

A separate bank account is not a requirement, simply it is a really good thought. Information technology is all-time to continue your business and personal finances separate. If you are applying for annihilation that requires proof of income, and your income is from a business (as is the case when you're paid for independent contractor work) a dedicated business account volition get you lot taken much more seriously.

Do I have to do all of this if my Doordash delivery job is only a side hustle?

Y'all should do all this any time you want to include your Doordash income in anything that would require paystubs or verification. Whether you do your business equally though it'south similar a full time task or information technology'due south but function fourth dimension, it's still considered a business organisation.

Source: https://entrecourier.com/delivery/delivery-business/money-and-bookkeeping/doordash-pay-stubs-employment-verification/

0 Response to "Uploaded Doordash and Frubhub Came With It"

Post a Comment